Apple Inc: Buy Now Pay Later, Metaverse, AI, Self-Driving, and neary 100 Acquisitions

Technology is constantly evolving and we're always adapting to it!

Because of accessibility, what's new and exciting today can easily become the norm tomorrow -this may bring pioneering companies into a position of pricing power, but flexibility and adaptation are required to stay ahead of the game while leading and standing out.

Highlights

- Apple Inc is constantly evolving and exploring new ventures, like augmented reality, fintech, and AI

- Acquisition of Credit Kudos, a fintech start-up based in the UK and AI Music: an AI tool to generate tailor-made music

- The Reality Pro headset will be Apple's first step into the metaverse

- The Supplier Clean Energy Program

Some tech trends that have taken the world by storm are electric self-driving cars, buy-now-pay-later services, the metaverse, and artificial intelligence. The global pandemic has fuelled some of these (like the metaverse and AI) as people stayed home, causing a mini-reset in the global economy that later contributed to raising awareness of sustainability and introducing the buy-now-pay-later service.

Apple is the biggest rival of Android devices and one of the largest tech companies globally: the tech giant produces products such as the iPhone, Apple Watch, Mac, iPad, iPod touch, AirPods, Beats products, HomePod, and other accessories. It also offers services within its devices (e.g., Apple Music, App Store, iCloud, iTunes and Apple TV), contributing to its revenue. As a multinational enterprise, it has been paving new ways, exploring new ventures, and evolving as we know it. Apple Inc. constantly evolves and explores new ventures, like augmented reality, fintech, and AI.

Its worth noting that Apple Inc is known for its secrecy when it comes to deals. In 2014, Apple's head of worldwide corporate communications, Kristin Huguet, said, "Apple buys smaller technology companies from time to time, and we generally do not discuss our purpose or plans" - this was at the time she was the spokeswoman.

Apple's strategic way of acquiring a business includes frequently inviting other companies to show their technology that it can partner with or license. By February 2021, the CEO revealed that the company had bought nearly 100 companies since 2015. Bloomberg also reported that Apple expects to produce its first self-driving vehicle by 2026.

FinTech

The fintech space has been brewing with incentives. As interest rates rise, many consumers are also looking for opportunities to split payments and credit with lower borrowing costs. One of these includes buy-now-pay-later services. Although it has been under scrutiny in the past by regulators, BNPL recently made it into the mainstream.

To advance further, Apple is also dipping its toes into the finance industry! The tech giant recently announced its newest venture: a buy-now-pay-later service that allows its users to split payments for their purchases over six weeks. This exciting development comes after Apple's acquisition of Credit Kudos, a fintech start-up based in the UK.

Metaverse

Apple has been working on its augmented reality (AR) ambitions since 2015. The Reality Pro headset will be Apple's first step into the metaverse, possibly launching at this year's Worldwide Developers Conference around June. This device is expected to have both hand and eye tracking while attempting to create a 3D version of the iPhone's operating system.

Artificial Intelligence

There have been reports that its most recent iOS updates have started to include AI offerings. In 2022, Apple acquired AI Music, an AI tool to generate tailor-made music. The deal may enable Apple to integrate this AI offering into its music offerings.

Sustainability

Global warming concerns have also started reaching the surface, where we've seen many countries affected by floods, storms, and natural disasters. To counter this problem, companies have started committing to reducing their release of greenhouse gas.

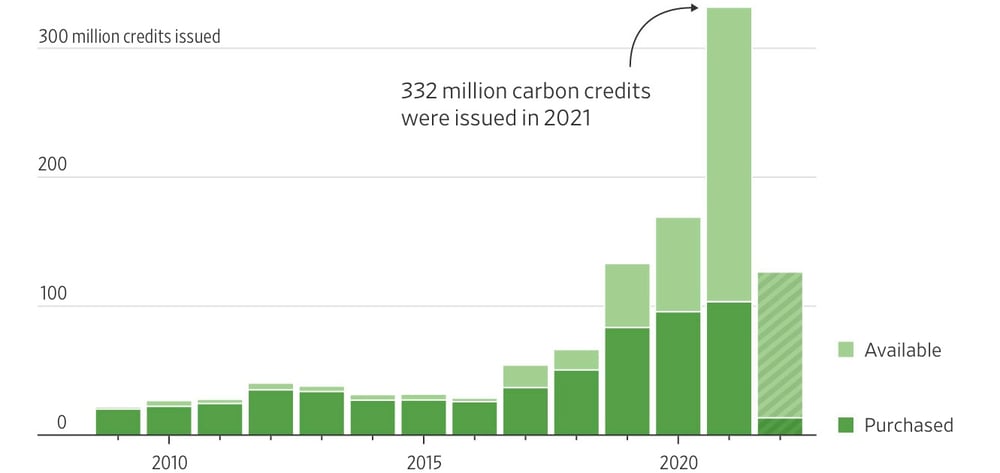

2021 has seen a surge in the issuance and purchase of carbon credits as more companies than ever are setting goals to reduce their carbon emissions, as the Wall Street Journal reported.

2022 data is through July 13, based on the year credits were issued—source: WSJ analysis of Verra and Gold Standard carbon credit registries.

By buying carbon credits, companies can reduce their carbon footprint and demonstrate their commitment to sustainability and environmental responsibility. We also note that most carbon emissions come from manufacturing Apple devices, and they will use the Supplier Clean Energy Program to reduce it. Last week, it revealed that over 250 global manufacturing partners have committed to this transition.

Financials

Divan Van Der Merwe, Business Analyst at Purple Group, explained: "Apple calculates its revenue (the total amount of money it earns), but it does not divide it into separate categories for each of its services (such as Apple Music, iCloud, App Store, etc.). Instead, it treats all of its services as a single entity and calculates the revenue earned by Apple's services as a whole."

In the first quarter of its financial year (FY Q1), Apple reported over 2 billion active devices. Despite the decline in its total revenue, its services businesses emerged as winners. In the first quarter, there was a 40.5% decrease in the number of personal computers (PCs) shipped by Apple. The market share of Apple TV+ grew to 7% in the third quarter of 2022 (vs. 4% of the comparative period in 2021).

"We set an all-time revenue record of $20.8 billion in our Services business, and, in spite of a difficult macroeconomic environment and significant supply constraints... We generated $34 billion in operating cash flow and returned over $25 billion to shareholders during the quarter while continuing to invest in our long-term growth plans," said Luca Maestri, Apple's CFO.

The tech giant's earnings per share at the time was $1.88 per share. According to Nasdaq, the firm's Price to Earnings (P/E ratio) for 2022 was 26.9x. The 2023 PE ratio expectation of 27.22x may have also priced in current macroeconomic factors hindering earnings in the short term. The board declared a dividend of $0.23 per share, which was paid in February 2023. Given the historical dividend payout, we can also assume it may pay again between May, August, and November this year.

Commoditization of technology and outlook

The technology sector is 'fast transforming' and can be competitive, and the fact that tech can be commoditized may also contribute to the competition within the industry. In addition, a factor that may hinder the production and distribution of this technology can include the current inflation elements and chip war. Chips play a crucial role in technology, and the global dependence shift has also affected the supply of these chips. This may also affect the earnings of the company during the period.

Apple may also continue to transfer its existing clients to new offerings and products. One of the ways Apple tries to achieve this is by halting support for old devices, which affects the user experience and may influence one to buy the latest version.

What investors may want to consider is the mood of consumers and the economic environment at the time it launches a new product/service, and how its competitors are either following (offering similar products/services at a lower price) or leading with more advanced and different features that enhance the user experience. "If the current conditions continue, the company may also delay many of their expected plans", Divan added.

Catch up on the latest research and news below!

Sources – EasyResearch, Apple Inc, Wall Street Journal. Bloomberg, HeadphonesAddict

Follow Cay-Low Mbedzi

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by an employee of EasyEquities an authorised FSP (FSP no 22588) as general market commentary and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.

-3.png?width=1200&length=1200&name=image%20(10)-3.png)