Advanced Micro Devices Inc is one of the most popular US shares on the EasyEquities platform – the 11th most popular to be exact. The company has released its Ryzen 7000 series of computer processors, which has leapfrogged AMD -- at least temporarily -- into the spotlight as the manufacturer of the highest-performing CPUs available to the general market

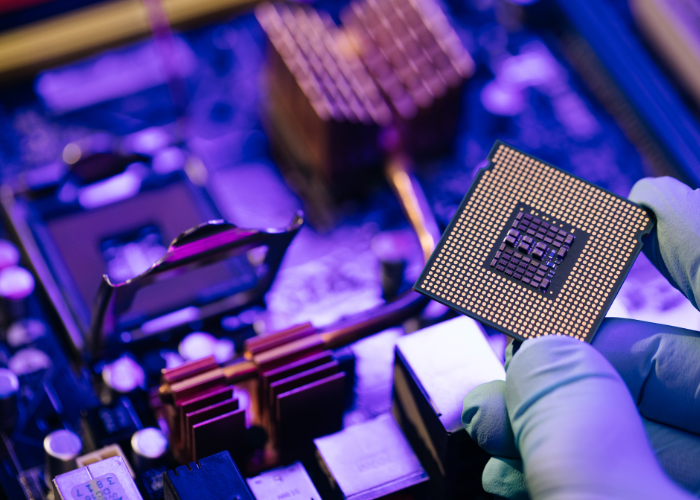

On September 27, 2022 Advanced Micro Devices (NASDAQ: AMD) released its Ryzen 7000 series of computer processors. That release leapfrogged AMD -- at least temporarily -- into the spotlight as the manufacturer of the highest-performing CPUs available to the general market.

Perhaps more importantly, the Ryzen 7000 series represents AMD’s first generation of chips on its new AM5 platform, a hardware architecture that the company expects to support at least through 2025 . It’s that new architecture that really has the potential to be a game changer for AMD.

According to tech4gamers.com, key features of the new platform include support for faster DDR5 memory and faster PCIe Gen 5 connections, which should enable even faster storage and graphics cards. In addition, all AMD CPUs on the Ryzen 7000 series now ship with onboard graphics. That’s a huge win for AMD’s ability to reach business clients, for whom processing power and portability often matter more than the ability to render the most stunning images in real time.

.

Login to view Advanced Micro Devices Inc (AMD) shares

on EasyEquities

Put all the pieces together, and AMD has launched an incredibly strong salvo in the battle for the hearts, minds, and wallets of people looking to buy new computers. Despite that incredibly strong launch, AMD’s competition is not sitting still. Not to be outdone, AMD’s arch-rival Intel (NASDAQ: INTC) recently announced its answer to Ryzen 7000. Intel’s answer is its 13th generation of the Core processors, which is expected to be available for sale by October 20, 2022.

While it’ll be hard to get independent benchmarks until Intel’s new chips are actually available, Intel is claiming improvements in both raw performance and in performance per watt. That later stat is particularly important for data centers and other computing-dense environments where power and cooling concerns are often at least as important as raw computing horsepower.

In addition, Intel’s 13th generation chips will come at a lower price tag than Ryzen 7000. That lower price tag comes in the form of both the cost of a CPU and -- for those upgrading from the previous generation -- a lower overall price for the system. This is because you need the whole new AM5 platform to buy the Ryzen 7000, while you can reuse most of the components from an Intel 12th generation system.

As a result, Intel looks like it will be making a fairly compelling case from an efficiency perspective -- both computing and cost efficiency. With what will likely be roughly comparable performance at a lower net price tag, Intel is certainly keeping the competition tight.

AMD’s great foundation for the future

While Intel’s greater efficiency argument will keep the competition interesting with this newest generation of processors, AMD may have the upper hand when it comes to the next generation. This is because while Ryzen 7000 is the first CPU on AMD’s AM5 platform, the 13th generation is expected to be Intel’s last on its existing platform. Intel’s 14th generation processors will launch with a new socket -- which will necessitate the same sort of platform upgrades for Intel the next time around.

All told, it is clear that the competition between AMD and Intel looks to be strong. That can bode incredibly well for consumers over time as each looks to gain a sustainable advantage over the other in their battle for your computing dollars.

Since the Ryzen 7000 series is AMD’s first offering on its new platform, it looks like it is setting itself up with a great foundation for the next several years. That, along with the strong performance numbers its 7000 series is already putting up, gives great reason to believe that AMD will see its fair share of wins in this battle.

Login to view Advanced Micro Devices Inc (AMD) shares

on EasyEquities

At the time of publication, Chuck Saletta owned shares of Intel and also had the following options positions on Intel: Short June 2023 $37.50 Puts, Short June 2023 $55 Calls, Short January 2024 $52.50 Puts, Long January 2024 $52.50 Calls.

New to investing

and want to know more about our other stock picks?

Read: August Stock Sale

Sources –EasyResearch, wcctech, digital trends, Intel, Tech4games, PC Gamen, Serve The Home, Tech Rader, PC Gamer

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by an external contributor as general market commentary and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.