Suitability: This is one of three listed exchange-traded funds which provides exposure to SA’s commercial property market. Investors can use the ETF in a number of investment strategies. For example, through an actively managed multi-asset investment strategy you can hold the Stanlib SA Property ETF and mix it with ETFs in other asset classes, and adjust the allocation to each according to market conditions.

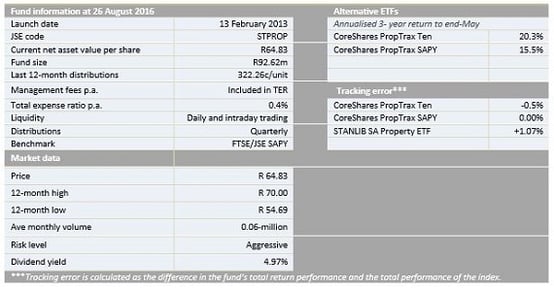

What it does: Stanlib SA Property ETF tracks the FTSE/JSE South African Listed Property Index (JSE SAPY) by holding constituent securities in the same weightings as they are held in the underlying index. It provides returns linked to the performance of the SAPY in terms of both price performance and income. The FTSE/JSE SAPY contains the top 20 most liquid property companies.

Advantages: Through a single investment, Stanlib SA Property ETF provides exposure to SA’s top listed commercial real estate at a low cost. Another attraction is its high dividend yield of 5%.

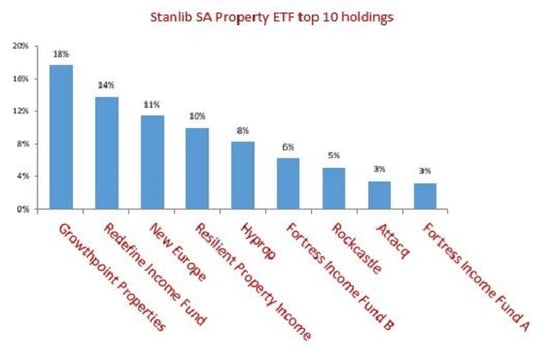

Disadvantages: Growthpoint Properties, Redefine Income Fund and New Europe account for 43% of the fund. The performance of the fund will be biased towards the performance of these three stocks. Also, the majority of the stocks at the tail of the JSE SAPY index lack trading liquidity, which increases tracking risk.

Top holdings: The top-10 holdings constitute 80% of the overall portfolio with Growthpoint and Redefine Properties accounting for the majority of that. The JSE SAPY Index is made up of property stocks with primary listings in SA only. That effectively excludes Intu Properties and Capital & Countries Properties which are UK focused.

Risk: Unlike most ETFs which usually invest in a diversified pool of assets or stocks, the Stanlib SA Property ETF invests solely in property stocks. This exposure to one sector makes it less diversified than other non-specialist ETFs on the market. But by the same token it has potential for higher returns.

Fees

Expenses take on average 0.4% from the fund each year.

Historical performance

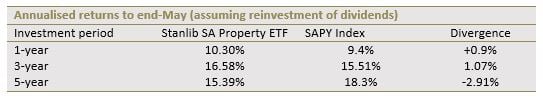

Over the past five years, property stocks have outperformed most of SA’s traditional equities and bonds benchmarks. The Stanlib SA Property ETF benefited from this strong performance in property stocks, returning 15.39% a year over that period. That is, however, lower than the CoreShares PropTrax Ten and CoreShares PropTrax SAPY, which returned 20.5% and 17.8% a year over the same period respectively.

Fundamental view

The performance of property stocks is highly sensitive to the interest rate cycle. Higher rates mean higher finance costs and less cash flow available for dividends for equity investors. Property companies in SA have benefited from the low interest rate regime since the 2008/9 financial crisis. However, the low interest era is firmly in the rear view mirror, with six rate hikes since January 2014.

In its latest meeting on 21 July, the South African Reserve Bank left its benchmark repo rate on hold at 7%. The Monetary Policy Committee said it remained concerned about the weak economic growth outlook and the medium-term inflation trajectory which is expected to remain outside the target range of 3% to 6% until the second half of next year. However, it said its assessment of the balance of risks to the inflation outlook and the weak domestic economy provided some room to delay further tightening of the monetary policy stance. It is, however, uncertain whether the bank will maintain that stance at their meeting on 21 September given the signal from the US Federal Reserve that it might be considering hiking rates before the end of this year. US assets become more attractive to investors once rates rise in that country. This normally pushes some investors to withdraw some of the capital invested in emerging markets, including SA, which is often accompanied by a depreciation in emerging market currencies against the greenback.

Alternatives

Retail investors seeking exposure to property stocks have two other options: CoreShares PropTrax SAPY Ten and CoreShares PropTrax SAPY managed by Grindrod Asset Management. Refer to our previous notes for more information on these ETFs.

BACKGROUND: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, resource companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.