Intellidex Reviews: NewFunds S&P GIVI SA Industrial 25

Suitability: This is the third and final post in our series on specialist funds that invest in the three main subsectors of the JSE: financials, industrials and resources. These three sectors can provide the “building blocks” of a portfolio and active investors can adapt the weightings in each sector according to their view of prospects.

Industrials are much broader than the other two sectors and cover a range of disparate industries which do not respond uniformly to the same set of external factors such as interest rates or commodity prices. That lowers the risk profile of industrial sector funds. Whereas financials and resources are suited to more active investors wanting to take bets on the prospects of specific segments of the economy, industrials suit a semi-active investor who can tolerate the volatility of equities.

Absa’s NewFunds S&P GIVI SA Industrial 25 ETF is one of two JSE-listed ETFs that give you exposure to the industrial sector. The other is the Satrix INDI. The NewFunds ETF selects industrial companies assessed to have the highest “intrinsic value” with low volatility while the Satrix INDI selects the biggest companies based on market capitalisation (share price multiplied by the number of shares issued).

Click here to find out general information and benefits of ETFs.

What it does: The NewFunds S&P GIVI SA Industrial 25 ETF replicates the price performance of the S&P GIVI SA Industrials Index, which represents 25 industrial stocks with the highest intrinsic value and lowest volatility, subject to certain liquidity constraints. “Intrinsic value” is defined as the book value of the company adjusted for future earnings prospects derived from consensus forecasts of financial analysts.

It rebalances the fund and pays dividends every quarter. If your trading account is held in a tax-free savings account, the dividend is untaxed.

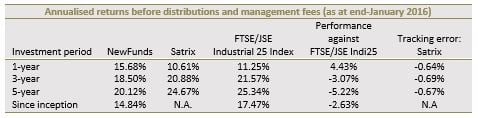

Please note that the NewFunds ETF uses the FTSE/JSE Industrial 25 index for benchmarking its performance, even though it tracks its own S&P GIVI SA Industrials Index. The Satrix INDI is constructed the same way as FTSE/JSE index so the performance is much closer to the benchmark.

Advantages: The fund construction approach provides potential for the ETF to outperform its benchmark.

Advantages: The fund construction approach provides potential for the ETF to outperform its benchmark.

Disadvantages: The fund weights its constituents by intrinsic value (defined above) so its performance differs quite considerably from the Indi25 index. However, its peer fund, Satrix INDI, uses the same weighting approach as the performance benchmark. In practice this means there is less diversity in NewFunds relative to Satrix.

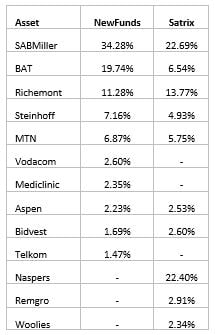

Top holdings: The top 10 holdings constitute 89.7% of the overall portfolio. The biggest stock, SAB Miller, makes up 34.3% of the fund.

Risk: SABMiller’s high weighting does present some concentration risk. Also, as with all equity investments, the fund is more volatile than other asset classes such as bonds and cash, but a relatively higher return should compensate for the elevated risk over time.

Fees: The annualised total expense ratio is 0.13%. This excludes brokerage and transactional costs.

Historical performance: The fund’s performance depends on the method used to invest. A lump-sum investment closely mimics the index performance. However, investing through regular instalments usually lags the performance of the index, according to historical evidence, and the pattern is apparent in other ETFs too. This supports the need to invest for longer periods when it comes to equities. The performance described in the table below is for a lump-sum investment.

As mentioned above, the ETF’s construction method is based on its own index, though it is benchmarked against the FTSE/JSE Industrial 25. This is why the performance against that index is so different to that of the Satrix fund in the table below. It has outperformed the benchmark on a one year view and underperformed both the benchmark and Satrix ETF for longer periods.

Fundamental view

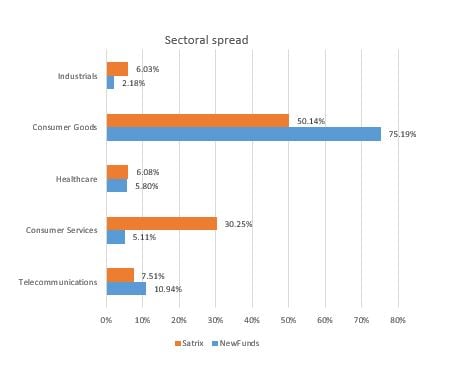

Industrials have produced the highest risk-adjusted returns in the past five years compared with the other two subsectors, financials and resources, characterised by high absolute returns and low volatility. The fund is likely to continue exhibiting low volatility given its sectoral diversity.

Consumer goods and services make up more than 80% of the fund and constituent companies generate a significant portion of their revenue outside of SA. As such, the fund stands to benefit from global stimulus policies designed to encourage consumption as well as from the non-rand earnings exposure.

Alternatives:

We have covered its closest peer, the Satrix INDI, in some sections of this note. This ETF is weighted according to market capitalisation but excludes locked-in shares such as those held by promoters, founders and governments.

BACKGROUND: Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, industrial companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the Easy Equities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

You can check out other ETF Tuesday posts here.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.