Suitability: If you are close to retirement or prefer a more stable investment than pure equity funds, this ETF provides a good option. It blends together various asset classes alongside equities, so in theory it is less risky.

The distinctive feature of NewFunds’ multi-asset ETFs (MAPPS Growth and MAPPS Protect) is that they bundle the various asset classes into a single investment, sparing investors the burden of creating a diversified portfolio themselves. Outside of these two ETFs, investors wanting to create a diversified portfolio can do so through unit trusts, by spreading savings across different single-asset class ETFs or by building their own mixed-asset portfolios. While these may achieve the goal, they are not as cost-efficient.

Our focus this week, the NewFunds MAPPS Protect ETF, is the more conservative of the two funds, with the bulk of the portfolio invested in government bonds. Because of this asset composition, the ETF’s returns should be less volatile than an investment in a pure equity portfolio, making it suitable to investors with a lower risk tolerance and a short time horizon.

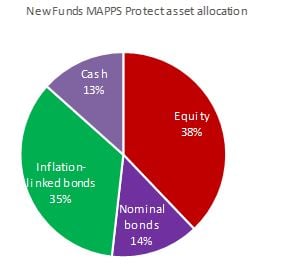

What it does: NewFunds MAPPS Protect replicates the total return performance of SA equities through the Swix 40 index, nominal bonds through the Govi index and inflation-linked bonds through Ilbi index. The cash component is held in hard cash or allowed money market instruments. The portfolio targets the following asset allocation: equities 40%; nominal bonds 15%; inflation-linked bonds 35%; and cash 10%. It may deviate from that between rebalancing exercises conducted on a quarterly basis.

Advantages: This ETF is provides an inexpensive way of accessing a well-diversified portfolio. It is diversified across asset classes and is further diversified through the underlying investments within each asset class.

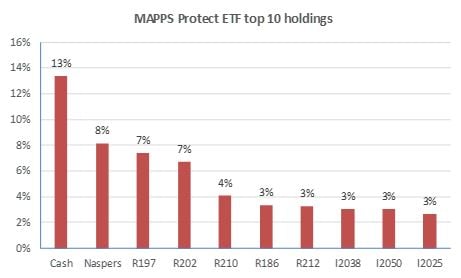

Top holdings: The top 10 holdings account for half of the fund’s assets. It is dominated by bonds with maturities of between seven and 12 years. From the equities constituents, only Naspers is part of the top 10 while the rest contribute less than 2% each. The cash component is at 13%.

Risk: Like all ETFs, there is a risk of capital loss. The structure of this portfolio is intended to carry lower risk than pure equities portfolios, with 38% of its funds exposed to equities and the balance exposed to less risky asset classes, particularly bonds. However, in a study of the local ETF market we found that, over the past five years, this fund was more volatile than some equities-only ETFs, though this was because of unprecedented volatility of bonds during the period.

Fees

Despite having to track more than 65 securities, which makes it one of the more diversified funds, MAPPS Protect has a reasonable total expense ratio. It charges an average of 33c/year for every R100 invested.

Historical performance

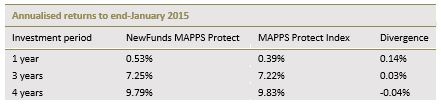

A R1,000 rand investment at inception about 4 ½ years ago would have been worth about R1,360 at end-January, assuming reinvestment of dividends. This implies an annualised return of 6.78% a year.

Fundamental view

Half of the fund is invested in bonds, so the performance of SA government bonds will have the biggest influence on its long-term performance. A 1% change in the value of the underlying bonds results in a 0.5% change in the net asset value of the ETF. While the past decade has been a superb period for bonds, rising interest rates and the spectre of a ratings downgrade for SA do not bode well for nominal bonds. Higher inflation expectations are good for the performance of the inflation-protected bonds but not for nominal bonds.

The performance of the money market portion of the fund is influenced by the same factors that affect bonds: the credit rating of the issuer, the term of the instrument and market interest rates.

The equities holdings are dominated by consumer goods & services, health care and financial stocks. These are dependent on economic growth prospects locally and globally. Because the global and local economy have both deteriorated over the past few months, the short- to medium-term prospects of the fund are not good. The fund is, however, invested in quality stocks, most of which have defensive qualities and are capable of doing well in the long term.

Alternatives

Investors with a slightly higher appetite for risk but wanting exposure to a diversified portfolio may consider NewFunds MAPPS Growth. It is more aggressive than MAPPS Protect with a 75% exposure to equities.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.