ETF ANALYSIS

Satrix Top 40 Index Fund

Performance review

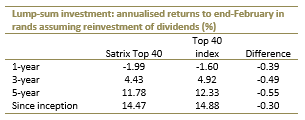

The JSE all share index has moved sideways for more than two years and the Satrix Top 40 exchange-traded fund – made up of companies that account for more than 80% of the JSE’s overall capitalisation – performed along similar lines, losing about 2% in the past year.

Outlook

Equities are driven by general economic activity. SA’s economy has performed poorly recently and the equities market has suffered, remaining largely flat for the past two years. Recent political developments which led to the downgrades of SA’s credit rating to junk status are likely to exacerbate an already precarious position. Bond yields have already risen and the rand has taken a tumble against major currencies, putting upward pressure on interest rates. However, the significant foreign exposures in the fund benefit from rand weakness, and often involve regions where economic growth is faster than SA’s.

Suitability

The Satrix Top 40 ETF is one of the most popular ETFs and is good for investors with a medium- to long-term investment horizon. It can be used as part of a core investment portfolio. Equity investments tend to exhibit higher short-term volatility than other asset classes, so a longer investment horizon gives a portfolio time for returns to accumulate ahead of volatility.

What it does

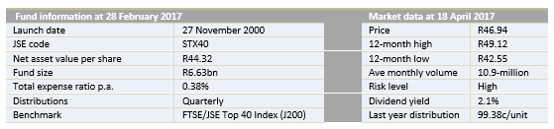

The fund tracks the value of the FTSE/JSE Top 40 index. The Satrix 40 exposes investors to the price performance of the FTSE/JSE Top 40 index and pays out, on a quarterly basis, all dividends received, net of costs. In order to reduce costs and minimise tracking error, the Satrix 40 engages in scrip lending activities with Investec and Sanlam, for which it earns fees. Constituent companies are weighted according to market value, which means the price movement of a larger constituent company will have a larger effect on the price of the index than that of a smaller company.

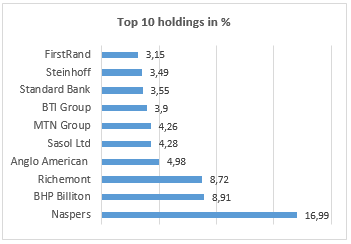

Top holdings: The top 10 holdings of this ETF make up 62% of the fund. The biggest one, Naspers, constitutes 17%, which diminishes the diversification benefits one usually obtains with ETFs.

Top holdings: The top 10 holdings of this ETF make up 62% of the fund. The biggest one, Naspers, constitutes 17%, which diminishes the diversification benefits one usually obtains with ETFs.

Risk: In addition to being a 100% investment in equities –which is a riskier asset class than bonds or cash – its weighting methodology introduces idiosyncratic risk due to big exposures in heavyweights such as Naspers.

Alternatives

Its closest peers are the Stanlib Top 40 (total expense ratio: 0.25%) and Ashburton Top 40 (total expense ratio: 0.18%) ETFs. Ashburton’s fund is structured the same as the Satrix 40, but Stanlib’s weighting is adjusted for free-float. A free-float adjustment excludes locked-in shares (such as those held by holding companies, founders and governments) and cross-holdings (where a listed company, such as Remgro, Reinet or PSG, owns a chunk of another listed company).

Its other cousins are Swix-weighted funds – the Satrix Swix (total expense ratio: 0.42%) ETF and Stanlib Swix (total expense ratio: 0.33%) ETF. These only consider the free-float market capitalisation of companies that are held on the JSE register. This means companies that are listed on the JSE but mostly traded on other markets such as London are held in a lower proportion.

Another alternative fund that eliminates the concentration exposure problem that the Satrix fund has with Naspers, for example, is the Coreshares Top 40 Equally Weighted (total expense ratio: 0.29%) ETF. This fund invests in the top 40 companies in equal proportions of 2.5% each.

Overall, the Ashburton Top 40 ETF has the lowest total expense ratio, making it the least expensive for investors from this family of funds.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you enjoyed reading this blog you might want to check out some of our other Intellidex research:

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|