This week we look at the second of the two ETFs launched recently which offer South African investors an alternative to the DB x trackers for investing in global markets.

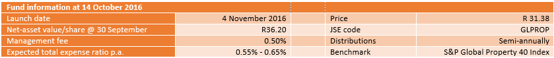

CoreShares, owned by investment groups Grindrod, RMI Investment Managers and Yellowwoods Capital, recently listed the CoreShares S&P 500 ETF and CoreShares S&P Global Property ETF.

Suitability

If you want to enhance your portfolio diversification by asset class, geographical spread and currency exposure, the CoreShares S&P Global Property ETF is worth considering. The other listed international ETFs all offer diversified equity exposure but this fund focuses on real estate. Although it is an equity investment, the real estate focus gives it unique diversification benefits. However, it should be considered for a long-term investment horizon given that equity investments have high short-term volatility but tend to outperform other asset classes over longer periods.

What it does

The ETF tracks the price and yield performance of the 40 largest stocks (by float-adjusted market capitalisation) of the S&P Global Property Index. Every constituent is capped at 10% of the fund at reconstitution, which reduces idiosyncratic risks. Other conditions that constituents must meet are: trading on a developed market; non-negative returns in the last fiscal year; and paid dividends in the last fiscal year.

Advantages

Other real estate funds listed on the JSE have limited foreign exposure in comparison as they are co-mingled with local property companies. This fund invests only in offshore property. Furthermore, the ETF is considered a local asset, which means investing in it won’t affect your offshore asset allocation limit of R10m per year.

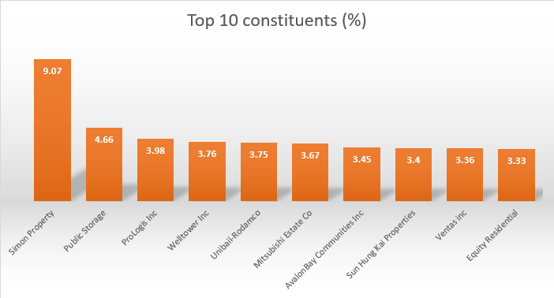

Top holdings

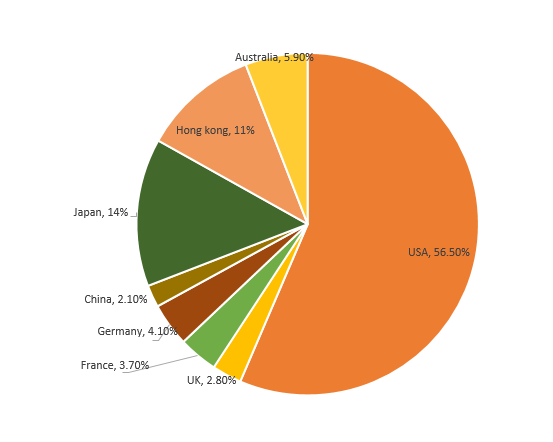

The top 10 holdings make up only 42% of the overall portfolio with the biggest asset, Simon Property Group A, constituting 9.07%. Retail real estate investment trusts (Reits) constitute the lion’s share of the holdings with 31.5% while exposure to the US property market at 57% is the single biggest country exposure among eight economies.

Risk

The risk factors are twofold. First, this is a 100% investment in equities, which is a riskier asset class than bonds or cash, but the returns over time should compensate for volatility. Second, it has a high sector concentration, although the diversification within subsectors (such as retail, residential, office, industrial, health care and hotel Reits) should reduce the risk level. However, to extract most value from this fund it should form part of a more diversified portfolio.

Fees

CoreShares will have a total expense ratio (TER) of between 0.55% and 0.65%.

Fundamental view

Property values respond to the level of interest rates and economic activity. As interest rates rise, interest payments go up, which means most property stocks have less cash flow available for dividends. Also, the rising cost of borrowing suppresses property prices, diminishing their appeal as income providers. More than half the fund’s holdings are in the US, where interest rates are expected to rise shortly, possibly this year. Furthermore, US president-elect Donald Trump is on record as saying he wants to significantly reduce taxes and spend $1-trillion in developing infrastructure. Both measures would increase the budget deficit and likely force the government to increase its borrowing, which would put more upward pressure on interest rates.

However, investment in this fund does enhance diversification by asset class, geography and currency. And should the rand continue to weaken, it will boost returns from the fund.

Alternatives

There is no direct alternative for the Coreshares S&P Global Property ETF. There are three other listed property funds but they have significant local holdings and their foreign exposure is largely in Europe.

About Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, US-listed companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

|

|