![ETF-hero[1].png](https://research.easyequities.co.za/hs-fs/hubfs/ETF_Tuesday/2017/25%20April%2017/ETF-hero%5B1%5D.png?width=553&height=389&name=ETF-hero%5B1%5D.png)

Performance review: Resource shares have been stellar performers over the past two years. The general mining index, which is made up of mining heavyweights such as Anglo American, BHP Billiton and Glencore, has recovered well from the 2014 dip, growing 65%. The gold miners index grew 58% over the period on the back of a 17% improvement in the rand gold price. The platinum mining companies index grew 39%. The chemicals and forestry and paper segments were the laggards, and have been largely flat.

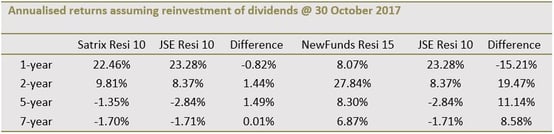

NewFunds S&P GIVI SA Resource 15 and Satrix Resi 10, the only two ETFs that track the resources indices, have benefited from the increased investor demand for mining counters. NewFunds S&P GIVI SA Resource 15 returned 27.84% a year during the two years to end-October ahead of Satrix Resi 10 which returned 8.37%.

The main reason for the difference in performance lies in the methodologies used by the underlying indices. The JSE Resi 10, which is followed by Satrix, is a pure capped index which pulls the top 10 resources counters from the JSE’s all share index. The S&P GIVI SA Resources Index selects its constituents based on the “intrinsic value” and lower volatility, subject to certain constraints such liquidity and market capitalisation of stocks. While the two methodologies often select the same counters, they differ significantly on the weights attached to each counter – the main reason for the differing performances. The JSE Resi 10 tends to be heavily geared towards mining counters whereas the S&P GIVI SA Resources Index tend to have a significant exposure to non-mining companies.

Invest in Satrix Resi 10

Outlook: The World Bank’s latest projections predict further improvements in commodity prices in the coming year. The report says oil prices will benefit from steadily growing demand, agreed production cuts among oil exporters and stabilising US shale oil production. Sasol will benefit from this. After a 22% jump this year the bank expects the metals index to stabilise next year as a correction in iron ore prices is offset by higher prices in other base metals. Mining companies will benefit if prices firm as projected.

However, prospects for South African mining companies are dampened by uncertainty over mining policy. Most mining houses have frozen investments into South African assets due to a lack of clarity on the mining charter and amendments proposed to the Minerals and Petroleum Resources Development Act. This obviously can have ripple effects on production levels in the sector and affect profitability. Moody’s ratings agency recently issued a report indicating that regulatory uncertainty in SA, coupled with a firmer rand against the dollar, would hasten the closure of the country’s gold and platinum mines, which are already buckling under high costs.

Invest in NewFunds S&P Givi Resi 15

However, these two ETFs are exposed to the global mining sector so SA-specific risk is quite small.

.jpg?width=1024&name=14112017(1).jpg) Suitability: NewFunds S&P Give Resi 15 and Satrix Resi 10 are specialist funds that invest in resource shares. Their constituents, which are exposed to commodity prices, are likely to move in tandem. While this is a plus during a commodity boom it often results in large losses during a downturn. Largely because of that, these ETFs suit investors who can stomach return variability and already have a diversified portfolio.

Suitability: NewFunds S&P Give Resi 15 and Satrix Resi 10 are specialist funds that invest in resource shares. Their constituents, which are exposed to commodity prices, are likely to move in tandem. While this is a plus during a commodity boom it often results in large losses during a downturn. Largely because of that, these ETFs suit investors who can stomach return variability and already have a diversified portfolio.

Methodology: Satrix Resi 10 replicates the price performance of the FTSE/JSE Resources 10 index, which consists of the 10 largest companies ranked by full market value in the oil & gas and basic materials industries. NewFunds S&P Givi Resi 15 replicates the price performance of the S&P GIVI SA Resources Index, which represents the top 15 resource stocks from the S&P GIVI (Global Intrinsic Value Index) SA composite index of general equities.

Top holdings: Satrix Resi 10 is dominated by mining companies. More than two thirds of its funds are in mining stocks. NewFunds S&P is evenly split between mining and non-mining counters. Both ETFs have huge concentrations in their top three counters.

Risk: Both ETFs are 100% investment in equities with limited sector diversification. Equities are riskier and prices are more volatile than bonds or cash.

.jpg?width=554&height=247&name=14112017(2).jpg)

Fees: NewFunds Resi 15 with a TER of 0.16% is far cheaper than Satrix Resi which costs 0.41% a year.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.