A guide to asset allocation!!

ETF ANALYSIS

A guide to asset allocation

This week we delve into a different area of portfolio management: asset allocation and how you can use ETFs to do it. Asset allocation is about how to spread a portfolio between the main asset classes – principally:

- equities (shares in companies or funds that contain shares in companies)

- bonds (these are instruments that represent the debts of companies or government entities that pay a fixed rate of interest. Retail investors usually access these by investing in funds that are invested in them)

- cash (deposits which earn a variable interest rate or funds that invest in the money market)

- other asset classes like property and commodities.

One study showed that more than 91.5% of investment returns are attributed to asset allocation. Individual stock selection and market timing within asset classes accounted for less than 7% of a diversified portfolio’s return. So the decision over how much to put into bonds vs equities is more important for your long-run returns than which shares or bonds you buy within each of those asset classes.

The good news is that ETFs allow you to create your own asset allocation strategy for you. Not only can you choose from different funds to create your own asset allocation, there are also funds available that blend asset classes for you according to your needs. And when you do it through a tax-free account, you don’t have to worry about any of the tax implications.

First we discuss how you can use ETFs to make your own asset allocation. Then we discuss the issues that matter in determining what asset allocation is best.

How to use ETFs for an asset allocation strategy

For the equities asset class, there are many options available, including:

- NewFunds SWIX 40 ETF, which invests in the top 40 JSE-listed shares, weighted by domestic share registers rather than the whole market cap of the companies. (Stanlib SWIX is similar)

- CoreShares Top 40 Equally Weighted ETF, which invests in the top 40 but weights them all equally (so each company is 2.5% of the fund).

- Satrix 40, the classic ETF that invests in the JSE’s Top 40 weighted by the index. (Stanlib Top 40 is similar)

For the bonds asset class, there are fewer options, including:

- Ashburton Government Inflation ETF, which invests in a portfolio of inflation-linked bonds, so yields are always a small margin over inflation. (NewFunds ILBI ETF Portfolio is similar)

- NewFunds Govi ETF, which tracks the government bond total return index, so is invested in a wide portfolio of government bonds.

For the cash asset class there is only one ETF, which tracks three-month deposit rates:

- NewFunds TRACI 3 Month ETF.

For property there are also a few choices:

- Stanlib SA Property ETF, which tracks the SA Listed Property Index, containing a diverse portfolio

- CoreShares PropTrax Ten, which focuses on the 10 biggest property companies within the SA Listed Property Inex, weighted by investable market capitalisation.

Unfortunately there are not yet any ETFs that are eligible for TFSAs that invest purely in commodities, because they tend to be unable to diversify widely enough between commodities. But between the funds available, there are plenty of ways to achieve a good asset allocation strategy.

So what matters in choosing between different asset classes?

Let’s start by focusing on the main two: equities and bonds. The difference is that equities are riskier than bonds. In equities, there is a chance of losing your money. In bonds, however, the return you will earn on the principal is known up front – to a point. Bond prices move as interest rates move (in opposite directions), so there is still some risk. There is also still some risk of default, although that is very rare, especially when you are invested in government bonds. Cash funds have much less interest rate risk, so the value of your investment is assured, though the return you earn varies with interest rates.

So the order of riskiness is equities, then bonds, then cash funds. Property behaves somewhat like bonds, but a little more like equity. Values of properties go up when interest rates go down because it is cheaper to borrow to buy property, but well-managed property companies can add equity-like returns if they get their properties to be more attractive to tenants.

A fundamental principle of investing is that investors should be rewarded for taking on risk. But this tends to only be true in the long run – so taking on risk is only appropriate if you are going to be investing for a long time.

In deciding the split between asset classes, the main issue to consider is the time horizon and liquidity. Your age and how much you depend on your investments to cover your day-to-day expenses determines the time horizon of your investment, which then defines your risk tolerance. Generally speaking, a longer time horizon means an investor can tolerate higher variability of asset returns. Equities are usually a good idea for time horizons of over five years, becoming more so the longer the time horizon. Because TFSAs are meant to be long-term investments, they lend themselves to equities. That’s also because the tax benefits mainly favour equities – interest returns are already tax free outside of TFSAs up to quite high thresholds, depending on your age.

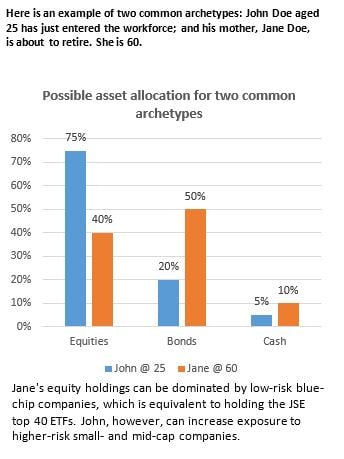

There are various quantitative and complex ways of establishing the portion of each asset class in an investor’s portfolio. But there is a common rule-of-thumb approach which, by experience, works quite well: allocation to equities should roughly be = 100 minus investor’s age. The balance should be allocated to bonds/cash and perhaps some property. This applies to your whole savings position, not just your TFSA.

For instance, if you are 40 years old, the convention advocates for a 60% allocation to equities (or similar instruments), which carry higher risk than the other asset classes; and the balance of 40% to bond/cash-like equivalents. Naturally, a young person is deemed more risk tolerant because of a longer investment horizon and less dependence on the investments for income. As such younger adults can afford to take greater risks in the quest for higher returns. In contrast, those nearing retirement become less tolerant to risk and need to protect assets, because there is less time to recover in case of a market downturn. Older investors therefore need to allocate more bonds to their portfolios, which also provide regular income, which is often needed after retirement. Equities are more prone to bad short-term outcomes but with the promise of more attractive long-term returns.

You probably have retirement savings separate from your TFSA. Also, the tax benefit of a TFSA is particularly clear for equities and less so for bonds and cash because you are already exempted from tax on interest up to certain thresholds. So it probably makes sense to focus your TFSA on equities.

Investors should note that within the broad equities class there is a continuum of risk. Cyclical stocks such as resources, for example, are risker than a company with interests diversified across industries, such as Bidvest. Blue-chip companies, mostly the larger companies on the JSE that are tracked by the ETFs mentioned above, are also considered to be less risky than smaller companies.

Investors can take on the riskier ones during early stages of their working life but should gradually replace them with blue chips as they age. The same goes for bonds.

One can get an asset allocation by splitting your portfolio between the equity, bond, cash and property ETFs mentioned above.

We also mentioned that some ETFs do the job for you. These two contain a blend of asset classes:

- NewFunds MAPPS Growth ETF, is higher risk for younger clients. It invests 74% in equities, 9% in nominal bonds, 10% in inflation-linked bonds and 7% in cash.

- NewFunds MAPPS Protect ETF, is lower risk for older clients. It invests in equities 40%, nominal bonds 15%, inflation-linked bonds 35% and cash 10%.

This is just a guide: every individual has unique attributes which may warrant being over- or underweight in some asset classes.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.