CORESHARES PropTrax Ten

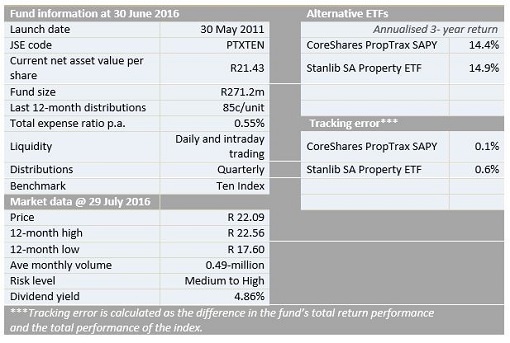

Suitability: This Grindrod-managed ETF is suitable for investors seeking a steady flow of income from property rentals (which usually escalate annually) while maintaining exposure to potential capital gains from rising property values. The fund is exposed only to property so it can be used as one of your portfolio’s “building blocks”, and active investors can adapt the weightings according to their view on prospects for the sector.

Real estate as an asset class has great portfolio diversification benefits. However, although property stocks are generally regarded as a separate asset class, they are still equities that exhibit high volatility. Therefore, they should not be used as an alternative to low-risk fixed income investments.

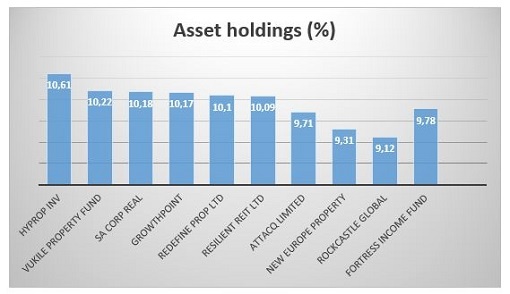

What it does: Coreshares PropTrax Ten tracks the FTSE/JSE SA Listed Property Top 10 Equal Index as closely as possible. It only buys constituent securities in the same weightings in which they are included in the index, and sells only those securities that are excluded from the index from time to time as a result of quarterly index reviews or corporate actions. This index consists of the top 10 companies, as measured by investable market capitalisation in the FTSE/JSE SAPY Index, and they are held in equal weightings of 10% each (as at the quarterly rebalancing date).

Top holdings: Its top 10 holdings constitute the entire fund.

Risk: It is one of the least diversified ETFs on the market because it invests only in property stocks, so all the asset returns tend to move together. However, the equal weighting ensures limited idiosyncratic influence of an individual stock, unlike the market-weighted SAPY index funds where the biggest stock, Growthpoint, takes up a fifth of the fund.

Fees

The total expense ratio is 0.55%, which means for every R100 invested in the fund, 55c goes to cover fund expenses including management fees.

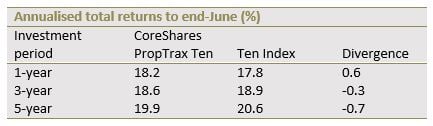

Historical performance

Fundamental view

The 10 companies in the portfolio have real estate as their underlying investments. Property values respond to the level of interest rates and economic activity. The central bank has taken a break from raising rates following three hikes since last June, but the trend remains upward. As interest rates rise, interest payments go up, which means most property stocks have less cash flow available for dividends for equity investors. This diminishes their appeal as income providers. SA’s stagnant economic growth is also likely to adversely affect vacancy levels for both commercial and retail properties. Furthermore, Brexit has reduced property values in the UK. This fund does not have direct exposure in the UK but is exposed to other parts of Europe which may be negatively affected by the Brexit fallout.

Alternatives

The two alternative funds are CoreShares PropTrax SAPY (also managed by Grindrod) and Stanlib SA Property Exchange Traded Fund. However, these two differ from CoreShare PropTrax in that they are weighted by market capitalisation and track the SAPY index, which captures the universe of listed real estate companies.

Background: exchange traded funds (ETFs)

Exchange traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets, in this case property stocks. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.