Intellidex Reviews: Cloud Atlas AMI Big50 ex-SA ETF

This new fund presents the first opportunity to invest in African markets, excluding SA, through an ETF.

The AMI Big50 ex-SA ETF is offered by Cloud Atlas Investing, a relatively a new boutique which will be focusing on companies in Africa, but excluding SA.

Suitability

The fund is ideal for investors with a medium- to long-term investment horizon. It can be used as part of a core investment portfolio. Equity investments tend to exhibit higher short-term volatility than other asset classes, so a longer investment horizon gives a portfolio time for returns to accumulate ahead of volatility. Because the fund invests exclusively in Africa, outside of SA, most markets are fledgling and have different risk characteristics to larger economies, including liquidity risk which may affect the fund’s ability to track its index. This can result in higher overall risk of this fund compared to other equity-based ETFs.

What it does

The AMI Big50 ex-SA ETF tracks the AMI Big50 ex-SA Index, which is a market capitalisation-weighted index designed to serve as a benchmark for a broader representation of African equity markets, excluding South Africa.

Main attraction

This is the only ETF on the bourse which offers relatively cheap access to African markets and it can be used in a tax-free savings account.

Major drawback

Capped indices like the one tracked by this ETF are likely to invest more in expensive stocks because their weight in the index increases as their prices rise, and fall as their prices declines. That approach means the fund will always have the biggest position in a stock when it is at its peak.

Top holding

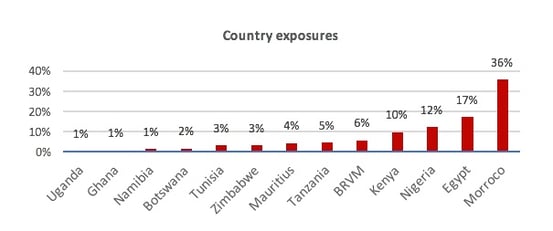

Just more than a third of the fund is invested in Moroccan counters followed by 17.2% in Egypt and 12.2% in Nigeria. Etissalat Al Maghrib, a Moroccan-listed telecommunications company with services in more than a dozen northern, eastern and central African countries, accounts for 20% of the fund. Coml.Intl.Bank and Lafargeholcim Maroc account for 11% and 6% respectively. The fund has a strong bias towards banks (29.32%), telecommunications (27.9%) and food & beverages (17.7%).

Risk

Because the fund invests outside SA but is traded in rands on the JSE, it exposes investors to exchange rate risk. A stronger rand will adversely affect its value and performance. We also see liquidity risk at fund level. Most African exchanges have very low liquidity. This may affect the fund’s ability to closely track its index. However, this is a risk at fund level and won’t affect the ETF’s liquidity on the JSE.

Fees

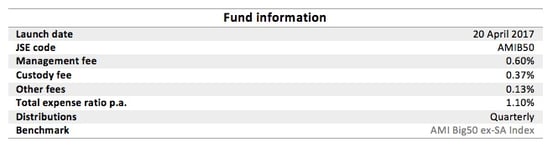

The AMI Big50 ex-SA ETF is expected to have a total expense ratio of between 1.1% and 1.2%, which looks pricey, with other ETFs having a TER ranging from 0.2% to 0.9%. More than half of the cost is for a management fee that ranges from 0.6% and 0.7%, depending on the assets under management. These costs reflect the fact that certain African markets have high transaction costs as a result of the lack of liquidity, as well as custody costs.

Historical performance

The listing document shows that the AMI Big50 ex-SA Index returned 16% a year over the five-year period to end-February 2017. That is a good return considering that the JSE Top 40 index returned 11% a year over that period.

Fundamental view

Africa has achieved impressive economic growth over the past 15 years with the continent’s average gross real domestic product (GDP) rising from just more than 2% during the 1980-90s to above 5% in 2001-14. In the past two years, growth has been more moderate but is expected to pick up this year. The international Monetary Fund expects growth for sub-Saharan Africa to come in at 2.8% this year and 3.7% next year. It projects higher growth from northern African countries which makes up the bulk of this ETF. SA’s economic growth is projected to remain lethargic at least for the next three years.

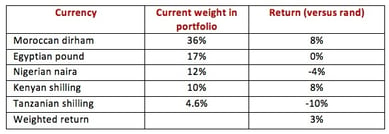

Given that the AMI Big50 ex-SA is invested in stocks denominated in non-rand currencies but measures its performance in rands, the rand exchange rate will play a crucial role in its performance. Effectively what investors in this ETF would like to see is a weaker rand against its basket of currencies. If the rand strengthens it would harm the ETF’s performance. The table below shows how the rand has fared against the top five currencies exposed to this ETF over the five years to end-February. If the ETF was launched five years ago it would have gained about 3% just from the exchange rate movements.

While the effect of the exchange rate movement in this case is a little bit soft, it can contribute as much as three quarters of the non-rand denominated asset’s return. A comparison can be made with the db X-tracker funds which follow developed markets, with the bulk of their returns over the past five years being due to the weakening rand against major currencies.

Alternatives

This is the only ETF which tracks African equity markets outside of SA.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex reviews: Satrix Property ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.